New Wake County Tax Valuations are Out!

Are you confused what the tax valuations mean for your tax bill?

Not sure how this relates to market value?

How does the math work with the tax valuation and tax rate to determine your tax bill?

Take a quick look and let me know if you need help figuring out your potential tax bill amount and if there is anything you can do to appeal the tax valuation. We have to make sure if we are asking the tax man to come out, it will be for your benefit and not to your detrminent.

The County reports in 2020, there were 17,500 requests for an informal review and approximately 6,500 submitted formal property tax appeals.

Of the appeals, Kinrade said roughly 60 percent resulted in an assessment decrease, but then 40 percent saw a hike.

Read more...

**** If your tax value went up considerably, do not go into panic mode in regards to your new tax bill. By all accounts, they are expecting to lower the tax mill rate so your overall burden is not as significant as it might be if the mill rates stay the same.

Carrie Schlegel

919-594-7183

carrie@CoreSoldit.com

Categories

Recent Posts

Touch Base Tuesday: HOA Database

Instant Reaction: Jobs, September 6, 2024

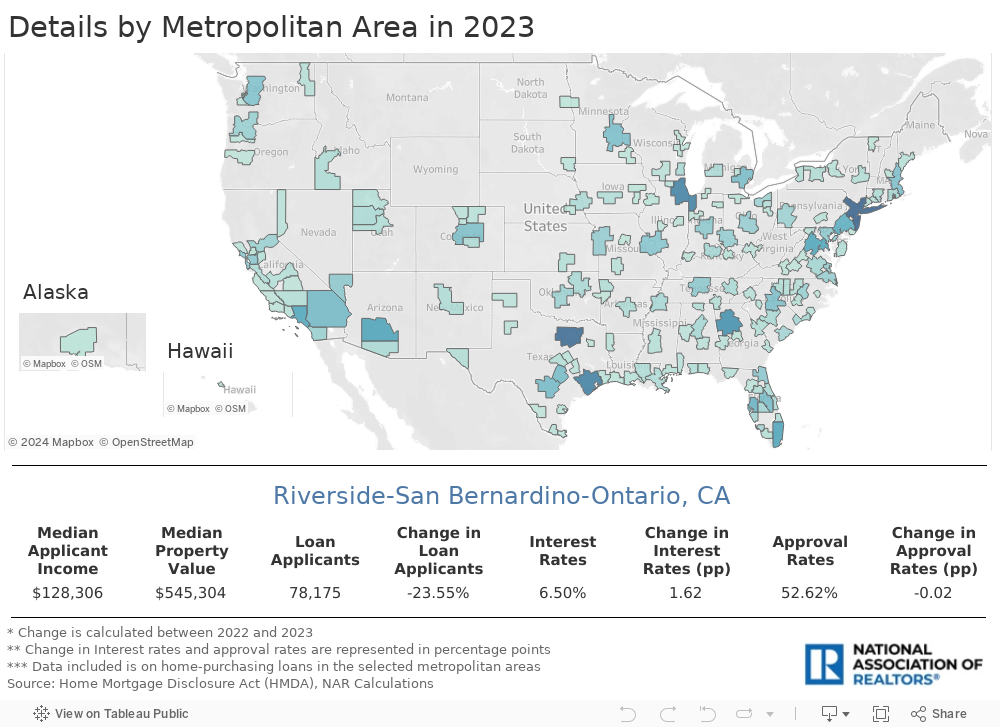

HMDA and Housing Demand

Instant Reaction: Mortgage Rates, September 5, 2024

August 2024 Commercial Real Estate Market Insights

Instant Reaction: Mortgage Rates, August 29, 2024

Pending Home Sales Dropped 5.5% in July

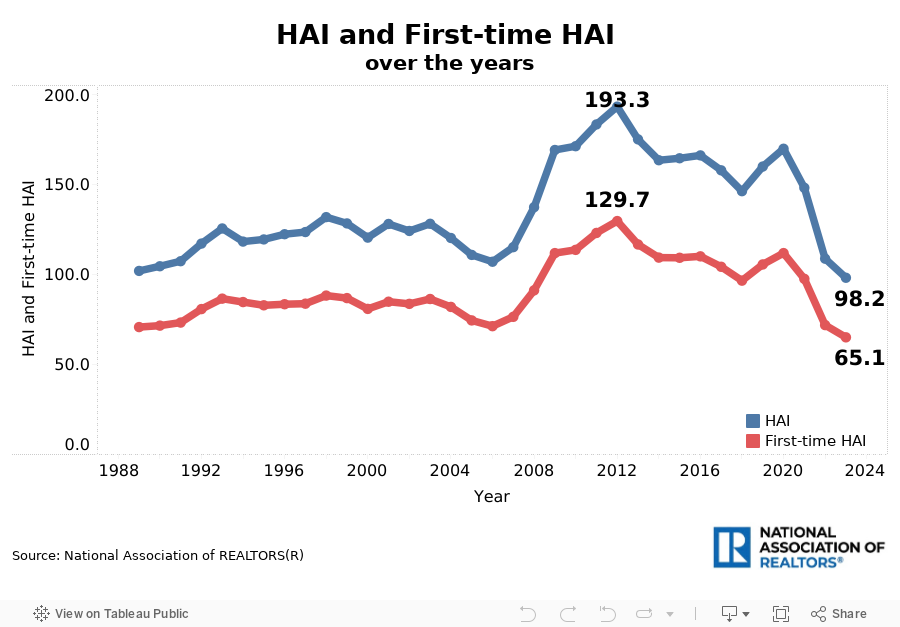

Trends in Housing Affordability: Who Can Currently Afford to Buy a Home?

July 2024 Foot Traffic

Existing-Home Sales Advanced 1.3% in July, Ending Four-Month Skid